Oil and oil stocks were the talk of the town yesterday, and there's seem to be some follow through this morning.

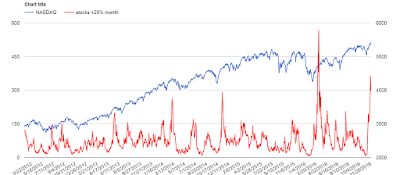

We have a lot of stocks extended in the short-term, and they need a little rest to set-up properly. How extended you might be asking, take a look at this chart;

Nasdaq vs. stocks up 25% or more in the last month.

Like every indicator, sometimes it works sometimes it doesn't.

Below is my watchlist for the day, I have an interest in these stocks/ETF's if and only if they go through yesterday's high with a special focus on the miners.

Frank Zorrilla, Registered Advisor In New York. If you need a second opinion, suggestions, and or feedback in regards to the market feel free to reach me at fzorrilla@zorcapital.com or 646-480-7463.

We live in a world in which we are bombarded with information, tweets, blogs, etc., content is the new salesman, content is the new marketing, content is the new networking. With information being so readily available, bloggers try to differentiate themselves with their writing skills, volume, and consistency, putting out blog posts to meet quotas. We are seeking to stand out from the crowd by showing performance, by taking all the information and seeking alpha, that’s the sole purpose of the blog. It won’t always be pretty; it’s never easy, and performance is spotty, but we seek superior risk-adjusted returns, not notoriety for our writing skills. If this is something you can relate to, then this blog is for you.

No comments:

Post a Comment