On March 4, 2015 after the close Vivint Solar (VSLR) reported earnings that took the street by surprise. Total revenues for the quarter were up 248% to $6.9 million dollars, for the full year they were up 309% to $25.3 million. Based on the stock reaction the next day +33%. the street not only love the numbers but they were obviously caught by surprise.

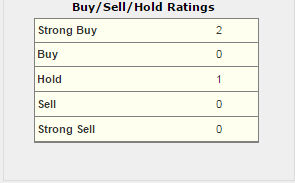

In my opinion VSLR is a typical PEAD situation. "Post Earnings Announcement Drift (PEAD) is the tendency for a stock’s cumulative abnormal returns to drift in the direction of an earnings surprise for several weeks (even several months) following an earnings announcement. PEAD usually works best on stocks that have been neglected for a long time, stocks that are not widely followed, and stocks that have low floats. VSLR has a small float (20 million shares), as you can see in the chart below prior to earnings the VSLR was neglected, and with only 3 Wall Street analyst ratings the stock is obviously not widely followed.

Technically speaking VSLR has digested the big one day gain by moving sideways allowing the 20 day moving average to catch up to the price of the stock, the stock is no longer extended. Currently I believe VSLR provides a decent risk reward opportunity, I would consider owning the stock on a move above $12.30 with a stop at $11.50. You have a catalyst in place (EPS), small float, 20% of the float is sold short, fairly new company, and its not widely followed.

No comments:

Post a Comment